WESTERN CPE BLOG

Providing the latest tax news, information, and updates for tax and finance professionals

What is an Enrolled Agent?

In the vast world of tax professionals, there’s room for more than one designation. When it comes to the tax, accounting, auditing, and finance industries there are various types of professionals trained to meet your needs. You may have heard the terms Accountant, Certified Public Accountant (CPA), or Financial Advisor, but what about the Enrolled Agent (EA)?

In this article we will dive into the world of an EA, or Enrolled Agent, by discussing:

- What is an enrolled agent?

- The enrolled agent exam

- Enrolled agent salary

- How to find an enrolled agent

What is an enrolled agent?

Enrolled aAgents, I do hereby knight thee into the Honorable Order of the IRS. Arise knights and be recognized with the highest credentials of tax preparation.

An Enrolled Agent (EA) is a federally-authorized tax practitioner. With their technical expertise in taxation empowerment given by the US Department of the Treasury, they can represent taxpayers before all administrative levels of the Internal Revenue Service (IRS).

EAs can:

- Prepare tax returns

- Provide tax planning and consulting services

- Represent taxpayers in IRS audits, appeals, and collections

Unlike CPAs, EAs are authorized to prepare and file tax returns for clients in all 50 states. They are able help their clients navigate the complex US tax code, and can provide valuable assistance with tax planning, compliance, and representation before the IRS.

Let’s go over a few other special abilities Enrolled Agents have that other tax preparers may not.

Represent taxpayers before the IRS

As explained above, Enrolled Agents are authorized by the US Department of the Treasury to represent taxpayers before all administrative levels of the IRS. They can represent clients in audits, appeals, and collections matters before the IRS, which other tax preparers may not be authorized to do.

Specialized expertise in taxation

Enrolled Agents are specifically trained in the field of taxation. They are required to pass a comprehensive exam covering elements of the US tax code. This allows the agents to provide a wide range of tax-related services, nationwide.

Compliance with IRS ethical standards

Because Enrolled Agents are required to comply with strict ethical standards established by the IRS, they are trusted to maintain confidentiality, provide accurate information to clients, and avoid conflicts of interest.

Two Certification Options

EAs are not required to have a college degree or pass a comprehensive exam. A candidate can pass the Special Enrollment Examination (SEE) or work for the IRS. Once an individual has worked for the IRS for at least five years in a position that involved interpreting and applying the US tax code, they may be eligible to become an EA without taking the SEE. Then, the individual is required to apply to the IRS along with documentation of their work experience.

The Enrolled Agent Exam

To become an Enrolled Agent, a tax practitioner must pass the SEE administered by the IRS. If accomplished, they will earn the highest credential for tax professionals recognized by the IRS. The SEE is one of the primary ways to become an EA.

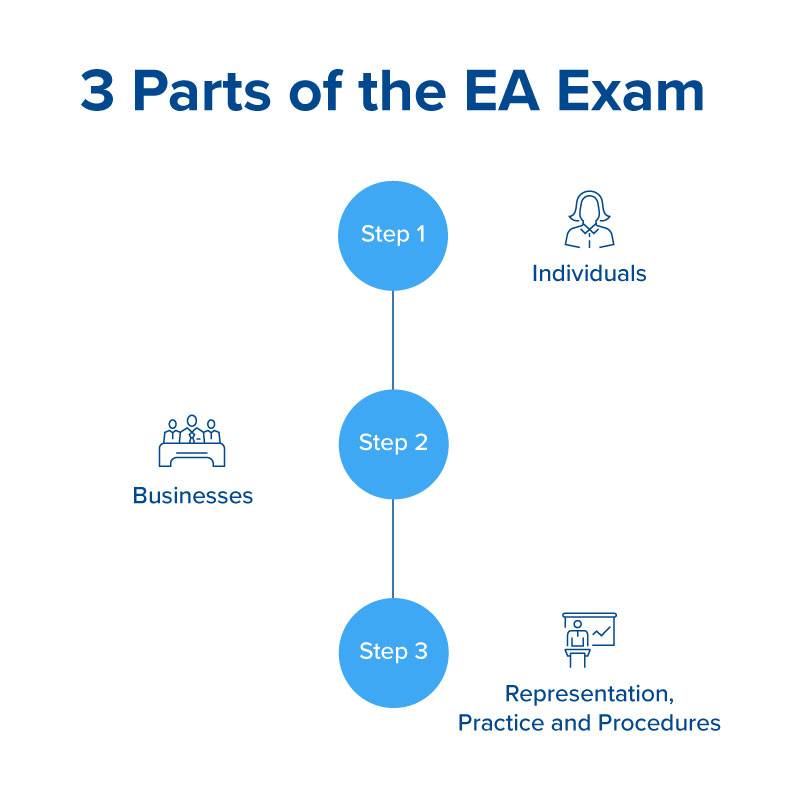

The three-part exam covers individual tax returns, business tax returns, and representation, practice, and procedures. Each section of the exam is made up of 100 multiple-choice questions, and candidates have four hours to complete each section. To receive a passing score, the candidate must score a minimum of 70% on each section of the exam.

The SEE is designed to test candidates on a wide range of tax-related topics, and references on the exam are to the Internal Revenue Code, forms and publications, as amended through the related year. To take the exam, candidates must first submit Form 2587 before scheduling online with Prometric.

If the candidate passes the exam, they still must meet other IRS requirements for enrollment. Those requirements include passing a background check and complying with ongoing education requirements to maintain their license.

What is an enrolled agent’s salary?

An enrolled agent’s salary can vary depending on several factors, including level of experience, client type, and the region of practice. The US Bureau of Labor Statistics lists the median yearly base salary for Enrolled Agents as $56,780. Other sources, including Glassdoor, Salary.com, and Indeed, place the average base pay in that same $50k-60k/year range.

There are other factors that play into an Enrolled Agent’s salary, such as independent or seasonal work. EAs who work for themselves or in private practice may earn more or less than this amount depending on the demand in their area, clientele monetary status, or their cost of service.

Some EAs are also seasonal, working mainly during the months of January through April for tax season. If working as an Enrolled Agent is essentially a seasonal practice for an individual, their salary could differ depending on their off-season work.

How to find an enrolled agent?

If you’re looking for an Enrolled Agent, it could be a much easier process than you’re expecting. There are a few different ways to scope out Enrolled Agents:

- National Association of Enrolled Agents (NAEA): The NAEA is a professional organization for EAs that offers a “Find a Tax Expert” search tool on their website. This tool allows users to search for EAs by location, specialty, and country.

- IRS Directory of Federal Tax Return Preparers: The IRS website offers a directory of tax return preparers, including EAs, who are authorized to prepare tax returns and represent taxpayers before the IRS. The search tool allows users to search for tax preparers based on country, zip code, distance, last name, and credentials.

- Other search tools and online directories: There are several other tools and online directories that can be helpful for finding tax professionals, including EAs. These include the active enrolled agents listing provided by the IRS under the Freedom of Information Act and the enrolledagent.com search directory.

When choosing the right Enrolled Agent for you, it’s important to consider their experience, expertise, and fees. Once you’ve found an agent or agents of interest, a consultation with to discuss your tax needs and wants before you decide to move forward.

-

Self-Study

Are You Independent?

$29.00 – $49.00 Select options This product has multiple variants. The options may be chosen on the product page -

Self-Study

Excel Tips to Boost Your Productivity

$29.00 – $49.00 Select options This product has multiple variants. The options may be chosen on the product page -

Self-Study

GAAP Hot Topics – What You Need to Know

$384.00 – $424.00 Select options This product has multiple variants. The options may be chosen on the product page -

Self-Study

The Risk of Abuse in Accounting Estimates: GAAP Insights and Audit Strategies

$58.00 – $78.00 Select options This product has multiple variants. The options may be chosen on the product page