Advising President Biden on Deductions and Credits

I think we all have ideas on what tax reform should look like. I’m putting a few items in writing as if I were advising President Biden. There are three basic assumptions considered in this discussion of President Biden’s tax proposals: (1) Our country has run up a big covid-related deficit, and we will have to pay the deficit down someday. (2) Our economy is fragile because of Covid, so legislators will need to consider the immediate impact on our economy of all proposed tax increases. (3) Tax law changes require Congressional action, with all of the political problems involved.

ITEMIZED DEDUCTIONS

President Biden has proposed two changes to itemized deductions. The President’s plan would cap the tax benefit of itemized deductions to 28% for those earning more than $400,000. He would also reinstate the “Pease” limitation. The Pease limitation, named after the late Congressman Donald Pease, reduced itemized deductions by 3% of AGI above a threshold. Presumably, the threshold in the Biden plan would be $400,000.

Tax practitioner note. Although removing the Pease reduction to itemized deductions was a benefit to high-income itemizers, the Tax Cuts and Jobs Act cut itemized deductions when the legislation limited Schedule A taxes to $10,000 and eliminated miscellaneous itemized deductions subject to the 2% of AGI limit.

28% benefit. If I were advising the President, I’d say that dropping the tax benefit of itemized deductions to 28% is drastic. At the least, the change should be phased in over the next four years (it’s not coincidental that four years matches the President’s first term.)

SALT

To soften the blow of reducing the tax benefit of itemized deductions, consider increasing the Schedule A state and local tax (SALT) deduction limit. It would be nice to suggest to President Biden that he propose the repeal of the SALT limit, but the Joint Committee on Tax estimates that repealing the SALT limit for just one year would cost $88 billion. That’s out if we want to tackle our budget deficit. Perhaps the SALT deduction could be increased from $10,000 to $20,000 to provide a little relief to taxpayers in high tax states, like me living and practicing in California. Yes, I am prejudiced, but before you in the low tax states say “no” to raising the SALT deduction, remember you and your clients may be next in wanting a change. Many state budgets (red and blue) have been hit hard by Covid. Income taxes, sales taxes, gas taxes, hotel taxes, etc. are all down. Expenses of running the state and local government are up. Thus, state taxes are going up.

PEASE.

From a tax practitioner’s and a taxpayer’s point of view, the Pease limit was always a stealth tax. Enter all of the itemized deductions on Schedule A, then surreptitiously reduce the “total” of itemized deductions by 3% of the excess AGI. President Biden, please drop this proposal.

QUALIFIED BUSINESS INCOME DEDUCTION

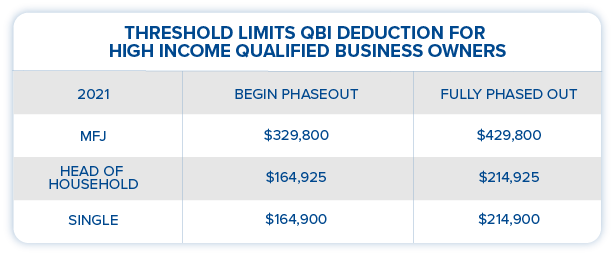

The QBI deduction is simple to understand and easy to implement for those with taxable income below the threshold amounts. For those with taxable income above the threshold amounts, §199A W-2 wage requirements and depreciable basis (also known as UBIA) calculations have resulted in 100s of pages of regulations. President Biden has proposed phasing out the deduction entirely as taxable income exceeds the threshold amounts. In other words, lower-income taxpayers would still be entitled to a 20% QBI deduction without regard to W-2 wages, depreciable basis, or specified service business restrictions. Wealthy taxpayers would no longer be entitled to the QBI deduction. To ease the impact of this change, the thresholds could be raised to match the top of the individual tax bracket (currently $523,600 for single and $628,300 for married filing joint filers.) Here are the 2021 QBI deduction thresholds.

RETIREMENT BENIFITS

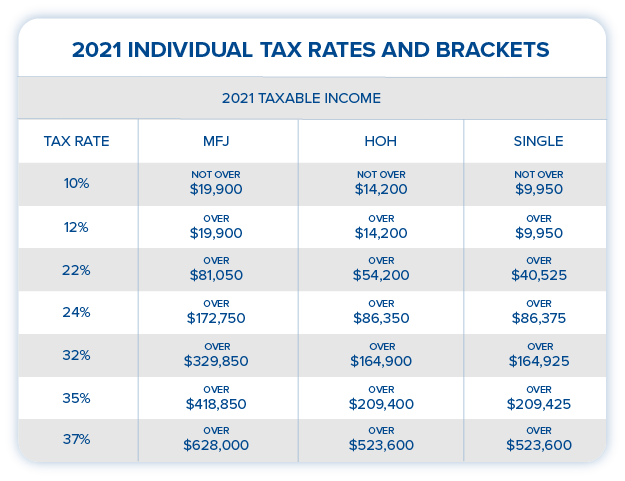

President Biden has proposed a refundable tax credit of a flat 26% for contributions to a retirement plan. A flat credit would boost the benefit of retirement savings for those in a low tax bracket and reduce the benefit for those in a tax bracket above the proposed 26% credit. If I were advising the President, I’d say that dropping the tax benefit of retirement contributions to 26% is drastic. This is going to need a political and economic compromise. Not only will the proposed retirement benefit change need to be phased in over the next four years (my arbitrary timeline to soften the blow of tax increases to our fragile economy), but the number is wrong. Maybe it can be a 26% refundable credit for low-income taxpayers to encourage savings, and perhaps it can be 32% non-refundable credit for those in higher brackets so that higher-income taxpayers are not discouraged from saving for retirement. Here is the 2021 tax rate chart for you to review when considering the advisability of the proposed retirement tax benefit changes.

CHILD TAX CREDIT

President Biden’s American Rescue Plan (ARP) enacted a one-year expansion of the Child Tax Credit (CTC). The credit begins to phase out at AGI of $200,000 ($400,000 for married filing joint taxpayers.) President Biden increased the child credit for one year to $3,000 per child ($3,600 for a child under age 6). The credit is fully refundable, and dependent children age 17 and under would qualify for the credit. This is the stimulus that is needed during the Covid crush. My only request would be that parents of dependent college students should qualify for the credit. Make the age of the qualifying dependent child 22 and under, as long as the child is a full-time student. Parents are continuing to pay tuition for their college kids, even though Covid has hit their income. They also need relief.

CHILD AND DEPENDENT CARE CREDITS

President Biden’s American Rescue Plan (ARP) enacted a one-year expansion of the Child and Dependent Care Tax Credit (CDCTC. The credit raised the maximum value of the child and dependent care tax credit for just one year to $4,000 for one child under age 13, or $8,000 for two or more children. The credit is refundable to help low-income families with their child care costs. Families making between $125,000 and $400,000 would receive a partial credit. My comment? It’s about time that the child care credit comes even close to the actual cost of child care. This should be a permanent change.

Note. President Biden’s American Rescue Plan (ARP) enacted one-year expansions of three refundable tax credits: the Child Tax Credit (CTC), the Earned Income Tax Credit (EITC), and the Child and Dependent Care Tax Credit (CDCTC).

EARNED INCOME CREDITS

President Biden’s ARP has introduced a few minor changes to the earned income tax credit (EITC). His credit raises the EITC for childless adults to $1,500, up from $538. His refundable credit removes the 65-year age cap so that the EITC would be available to more older workers.

End.

Sharon Kreider, CPA, has helped more than 15,000 California tax preparers annually get ready for tax season. She also presents regularly for the AICPA, the California Society of Enrolled Agents, CCH Audio, and Western CPE. You’ll benefit from the detailed, hands-on tax knowledge Sharon will share with you—knowledge she gained through her extremely busy, high-income tax practice in Silicon Valley. With her dynamic presentation style, Sharon will demystify complex individual and business tax legislation. She’s a national lecturer for business and professional groups and consistently receives outstanding evaluations. In 2014, she was awarded the prestigious AICPA 2014 Sidney Kess Award for Excellence in Continuing Education.