WESTERN CPE BLOG

Providing the latest tax news, information, and updates for tax and finance professionals

Which states have the highest income tax in the US?

There are many factors people consider when choosing a place to live, including location, weather, housing, pace of life, and affordability. Another factor some may consider is the income tax rate. Though there are various types of taxes in every state, the amount of income tax you’ll pay as a resident can have a significant impact on your overall financial situation and quality of life.

Some states in the U.S. have lower income tax than others, and nine states have no income tax at all. In most cases, that money is made up in a higher sales tax or a higher property tax. Then, there are states with higher income tax rates regardless of a resident taxpayer’s filing status.

A recent study conducted by FinanceBuzz found the states where individuals and couples will pay the highest and lowest percentage of their annual income in taxes for the 2022 tax year. By using Census data and updated federal and state tax rates, FinanceBuzz found that individual filers in the U.S. will pay an average of 19.60% of their income in taxes in the 2023 filing year. It also showed 25 states with a total effective tax rate for individual filers above the national average:

Massachusetts

Oregon

Connecticut

Maryland

New York

Hawaii

Virginia

New Jersey

Minnesota

Illinois

California

Utah

Delaware

Colorado

Georgia

Kentucky

Iowa

Rhode Island

Maine

Kansas

Michigan

Nebraska

Montana

North Carolina

Idaho

As we approaching the end of the 2023 filing season, let’s take a look at the 10 states with the highest individual income tax with the help of WalletHub’s updated state tax burdens.

10 States with the highest personal income tax burden

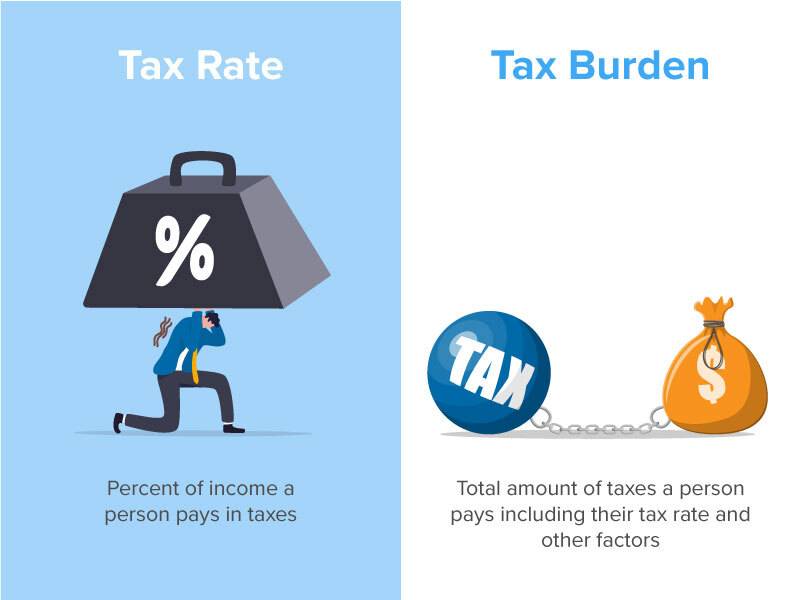

The 10 states listed below are ranked based on their total individual income tax burden as opposed to the individual income tax rate. What’s the difference between the two?

Tax rate refers to the percentage of a person’s income that is paid in taxes.

For example, if the tax rate is 20%, then a person earning $50,000 would pay $10,000 in taxes.

Tax burden refers to the actual amount of taxes a person pays, taking into account not only the tax rate but also other factors such as deductions and credits. This can vary greatly depending on a person’s individual circumstances.

For example, if a person’s income is $50,000 and their deductions and credits bring their tax liability down to $8,000, then their tax burden is $8,000.

Drum roll, please.

Here are the 10 states with the highest individual income tax burden in the United States:

New York- 4.72%

Maryland – 4.21%

Oregon – 3.62%

Massachusetts – 3.22%

Delaware – 3.15%

Minnesota – 3.11%

California – 3.05%

Kentucky – 3.04%

Connecticut – 2.92%

Hawaii – 2.86%

Potential Benefits of Paying Higher Income Taxes

Paying a higher state income tax can seem like a significant load on the financial surface, but there can be benefits to living in a state with high income tax rates or tax burdens. A few of those benefits could include:

Public services with a higher quality: Your state may have more funding available to invest in public services such as education, healthcare, transportation, and public safety leading to better infrastructure, better schools, and better access to healthcare.

Social safety net programs: High income tax rates can help fund social safety net programs like unemployment insurance, food assistance, and affordable housing to help state residents who are dealing with financial difficulties.

Lower property taxes: In certain states, high income tax rates may be offset by lower property taxes, benefitting local renters and homeowners.

Better investments for the future: Income taxes can also be used to invest in long-term projects to benefit residents in the long run, such as renewable energy, public transportation, and affordable housing. This can be highly beneficial for those who choose their forever home.

-

Self-Study

The Risk of Abuse in Accounting Estimates: GAAP Insights and Audit Strategies

$58.00 – $78.00 Select options This product has multiple variants. The options may be chosen on the product page -

Self-Study

Essentials of Nonprofit Fundraising

$232.00 – $262.00 Select options This product has multiple variants. The options may be chosen on the product page -

Self-Study

Pricing for Profit

$87.00 – $107.00 Select options This product has multiple variants. The options may be chosen on the product page