Western CPE

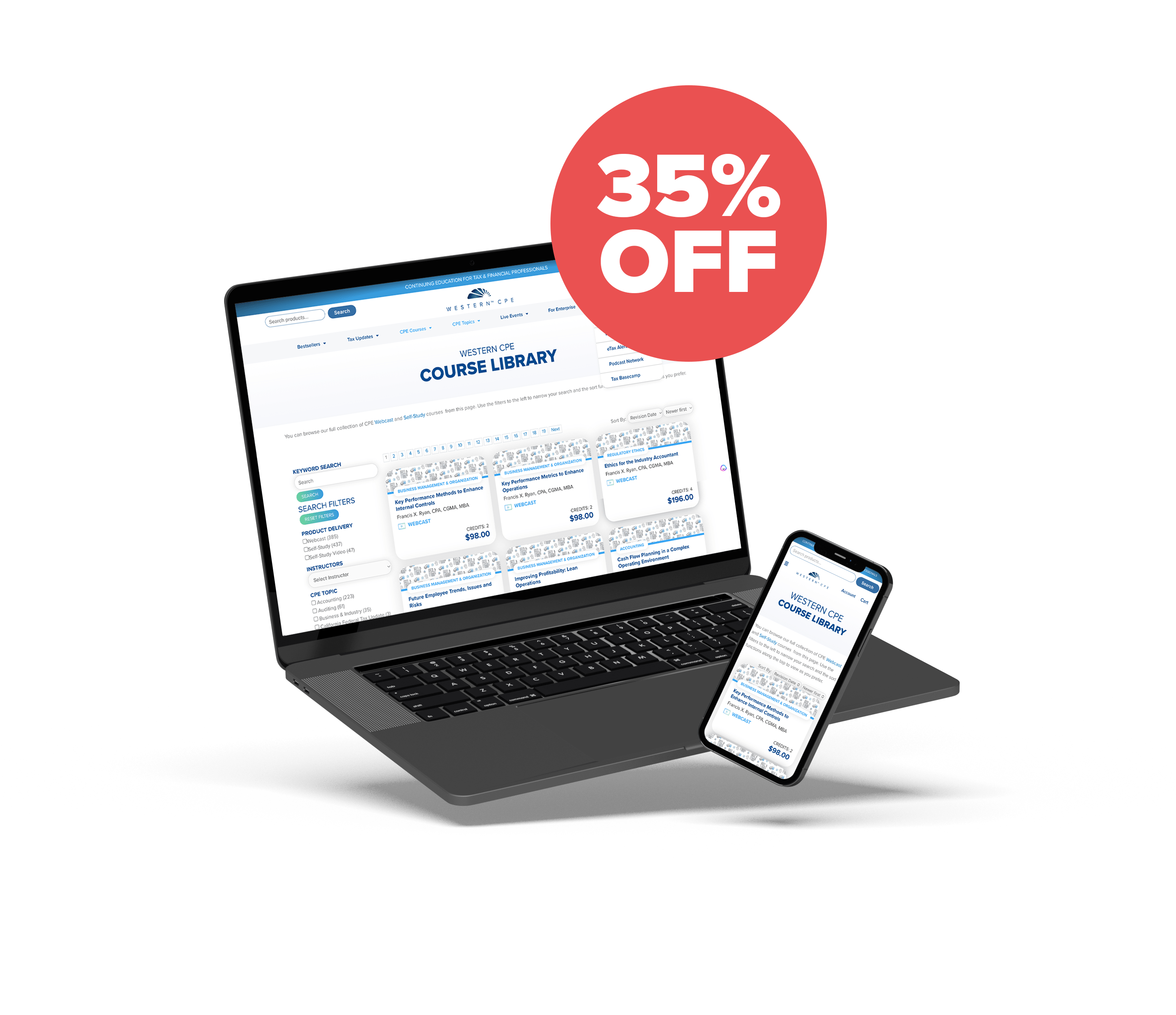

Course Library

20% OFF ALL DIGITAL CPE COURSES

All digital CPE courses are 20% off site-wide, including Webcasts, Self-Study, and Self-Study Video. (Discount is applied at checkout.)

20% OFF ALL DIGITAL CPE COURSES

CPE BUNDLE BUILDER

Choose any combination of CPE courses from our library totaling at least 4 CPE credit hours and receive 35% off.

You can browse our full collection of CPE Webcast and Self-Study courses from this page. Use the filters to the left to narrow your search and the sort functions along the top to view as you prefer.

Popular Topics:

-

Taxes

Taxes

Dealing with Debt & Interest

Danny Santucci, JD QAS Self-Study

Credits: 18 $396.00

QAS Self-Study

Credits: 18 $396.00$396.00 – $436.00

-

Taxes

Taxes

Estate Planning With Selected Issues

Danny Santucci, JD QAS Self-Study

Credits: 20 $400.00

QAS Self-Study

Credits: 20 $400.00$400.00 – $440.00

-

Taxes

Taxes

Small Business Tax Guide

Steven M. Bragg, CPA QAS Self-Study

Credits: 10 $290.00

QAS Self-Study

Credits: 10 $290.00$290.00 – $320.00

-

Taxes

Taxes

Home Office Deduction

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

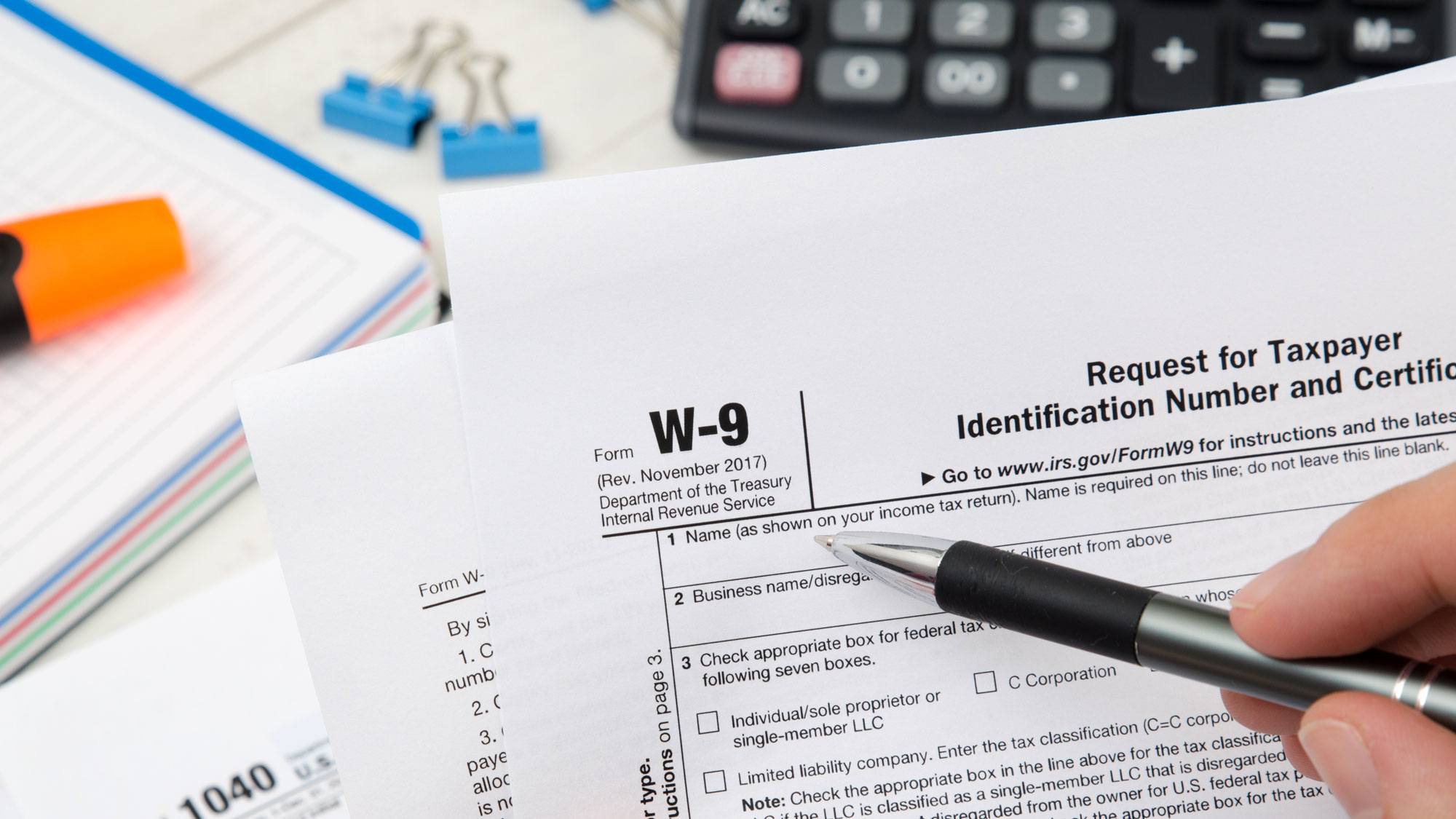

Form W-9 Compliance

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Real Estate Tax Guide

Steven M. Bragg, CPA QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Penalty Abatement for Fun and Profit

Mark Seid, EA, CPA, USTCP Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Taxes

Taxes

The Ultimate Guide to Retirement Planning

Danny Santucci, JD QAS Self-Study

Credits: 32 $640.00

QAS Self-Study

Credits: 32 $640.00$640.00 – $680.00

-

Taxes

Taxes

Family Tax Planning

Danny Santucci, JD QAS Self-Study

Credits: 24 $480.00

QAS Self-Study

Credits: 24 $480.00$480.00 – $520.00

-

Taxes

Taxes

Complete Guide to Estate and Gift Taxation

Danny Santucci, JD QAS Self-Study

Credits: 35 $700.00

QAS Self-Study

Credits: 35 $700.00$700.00 – $740.00

-

Taxes

Taxes

Bankruptcy Tax Guide

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

Estate Planning with Business Issues

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Defensive Divorce

Danny Santucci, JD QAS Self-Study

Credits: 15 $375.00

QAS Self-Study

Credits: 15 $375.00$375.00 – $415.00

-

Taxes

Taxes

Passthrough Business Deduction

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Making the Best of Bad Situations

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Property Dispositions

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Passive Loss & At-Risk Rules

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Partnership Taxation

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Employee Compensation & Benefits

Danny Santucci, JD QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Taxes

Taxes

Choosing the Right Business Entity & Getting Cash Out of It

Danny Santucci, JD QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Taxes

Taxes

Installment Sales

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Corporate Taxation

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Interest

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Basic Marital Tax Matters

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Selected Legal Issues with Tax Analysis

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Debt

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Entities & Title

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Retirement Plans

Danny Santucci, JD QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Taxes

Taxes

Basic Fringe Benefits

Danny Santucci, JD QAS Self-Study

Credits: 4 $116.00

QAS Self-Study

Credits: 4 $116.00$116.00 – $136.00

-

Taxes

Taxes

Education Tax Benefits

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Estate Tools & Trusts

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Medical, Charitable & Casualty

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Family Tax Planning

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Estate Planning

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Getting Cash Out of Your Business

Danny Santucci, JD QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Taxes

Taxes

Tax, Bankruptcy, and Financial Problems

Danny Santucci, JD QAS Self-Study

Credits: 3 $87.00

QAS Self-Study

Credits: 3 $87.00$87.00 – $107.00

-

Taxes

Taxes

S Corporations

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Business Travel & Entertainment

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

The Life Cycle of a Revocable Living Trust

Alice Orzechowski, CPA, CMA, EA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Taxes

Taxes

Fast Track Retirement Planning

Danny Santucci, JD QAS Self-Study

Credits: 2 $87.00

QAS Self-Study

Credits: 2 $87.00$87.00 – $107.00

-

Taxes

Taxes

SECURE 2.0: Securing a Strong Retirement Act of 2022

Alice Orzechowski, CPA, CMA, EA Webcast

Credits: 3 $147.00

Webcast

Credits: 3 $147.00$147.00

-

Taxes

Taxes

Assets, Income & Cash

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

IRC Section 121 and the Primary Residence

A.J. Reynolds, EA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Taxes

Taxes

Auto Tax Rules

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

Virtual Currency Taxation

Steven M. Bragg, CPA QAS Self-Study

Credits: 1 $29.00

QAS Self-Study

Credits: 1 $29.00$29.00 – $49.00

-

Taxes

Taxes

2025/2024 Easy Update & Inflation Adjustments

Danny Santucci, JD QAS Self-Study

Credits: 6 $174.00

QAS Self-Study

Credits: 6 $174.00$174.00 – $204.00

-

Taxes

Taxes

Divorce Transfers & Settlements

Danny Santucci, JD QAS Self-Study

Credits: 2 $58.00

QAS Self-Study

Credits: 2 $58.00$58.00 – $78.00

-

Taxes

Taxes

1040 Workshop: For 2025 Planning & 2024 Filings

Danny Santucci, JD QAS Self-Study

Credits: 24 $480.00

QAS Self-Study

Credits: 24 $480.00$480.00 – $520.00