California Tax Insights: A look at AB 150, SB 113, & Schedules K-2 & K-3

TRENDING NEWS

On February 15, the IRS stated their intention to provide certain additional transition relief for this year from the Schedule K-2 and K-3 reporting for certain domestic partnerships and S corporations with no foreign activities, foreign partners or shareholders, and without knowledge of partner or shareholder need for information on items of international relevance. For 2021, these qualifying domestic partnerships and S corporations will not have to file the new schedules.

Due to the feedback the IRS received from the tax community, they decided to provide further aid and explanation. The community voiced concerns caused by several weeks of confusion and frustration over updated instructions for schedules K-2 and K-3 that the IRS posted January 18 for filers of Form 1065, “U.S. Return of Partnership Income”; Form 1120-S, “U.S. Income Tax Return for an S Corporation”; and Form 8865, “Return of U.S. Persons With Respect to Certain Foreign Partnerships.”

NEW GUIDANCE

On February 16, the IRS has posted FAQs detailing the scope of filing relief for domestic pass-through entities subject to new international reporting requirements.

The new schedules, which took effect for the tax year 2021, apply to pass-throughs and their partners and shareholders that have “items of international tax relevance.” Partnerships and S corporations are required to report partners’ or shareholders’ total distributive share of international items on Schedule K-2 and to report a partner’s or shareholder’s allocable share of those items on Schedule K-3.

Many taxpayers and advisers initially assumed that the schedules needed to be filed only if a partnership or S corporation had foreign operations or foreign equity holders. But in the January 18 updated instructions, the IRS pointed out that entities with no foreign activities or equity holders might still need to complete portions of schedules K-2 and K-3 if a partner or shareholder claims a foreign tax credit and needs information from the entity to complete Form 1116, “Foreign Tax Credit.

Assembly Bill No. 150

In July, 2021, Governor Newsom signed Assembly Bill No. 150 (AB 150) which was California’s entry to the Pass-Through Entity (PTE) State and Local Tax (SALT) workaround. Over half of the states have passed their version of this PTE SALT workaround.

There is a lack of uniformity among the states about how this workaround is achieved. As always, California is unique.

IRS Notice 2020-75 gives a “stamp of approval” for these pass-through workarounds.

UTILIZE A RESOURCE

Take a look at Sharon Kreider’s November 23, 2020 article, discussing IRS Notice 2020-75. The notice IRS Notice 2020-75 gives a “stamp of approval” for these pass-through workarounds. We’re supposed to get regulations providing guidance on these workarounds, but that still has not been issued.

THE CALIFORNIA TAX & INSIGHTS BUNDLE

The California Tax Insights Bundle concisely looks at the critical client topics dominating tax season featuring AB 150, SB 113, and Schedules K-2 & K-3. Save up to 25% off today.

HOW DOES THE PASS-THROUGH ENTITY TAX (PTET) WORK FOR CALIFORNIA?

The PTET workaround requires a qualified entity with qualified owners. A qualified entity is a partnership, LLC, or S Corporation.

Qualified owners are corporations, trusts, estates, and individuals.

Partnerships are nonqualified owners.

Single member LLCs are not qualified entities.

For 2021, the qualified entity needs to make the election on a timely filed tax return which means the PTET payment needs to be paid by March 15, 2022.

For 2022 to 2025, the initial payment must be made by June 15, 2022. The June 15th payment is the greater of $1,000 or 50% of the previous year PTET payment.

If no payment is made by June 15, 2022, there is no PTET election.

WHAT ABOUT THE TAX DEDUCTION?

To claim the deduction on the 2021 tax return, the payment must be made by December 31, 2021. If it is paid by March 15, 2022, then the deduction will be on the 2022 tax return.

Because Of IRS Processing Delays of Amended Returns . . .

There is another consequence of the IRS backlog. Until the IRS processes a tax return, the Taxpayer Advocate Service (TAS) cannot assist the taxpayer. For that reason, TAS will not take on new cases to help you find an unprocessed (also known as lost) individual or business amended return. This is another reason to file amended returns electronically when you can. If you must send a paper return, at least send it certified or registered so that you know the return is in the IRS Service Center. “Lost in the building” is not a lot better than “lost in the mail”. But it’s better than nothing.

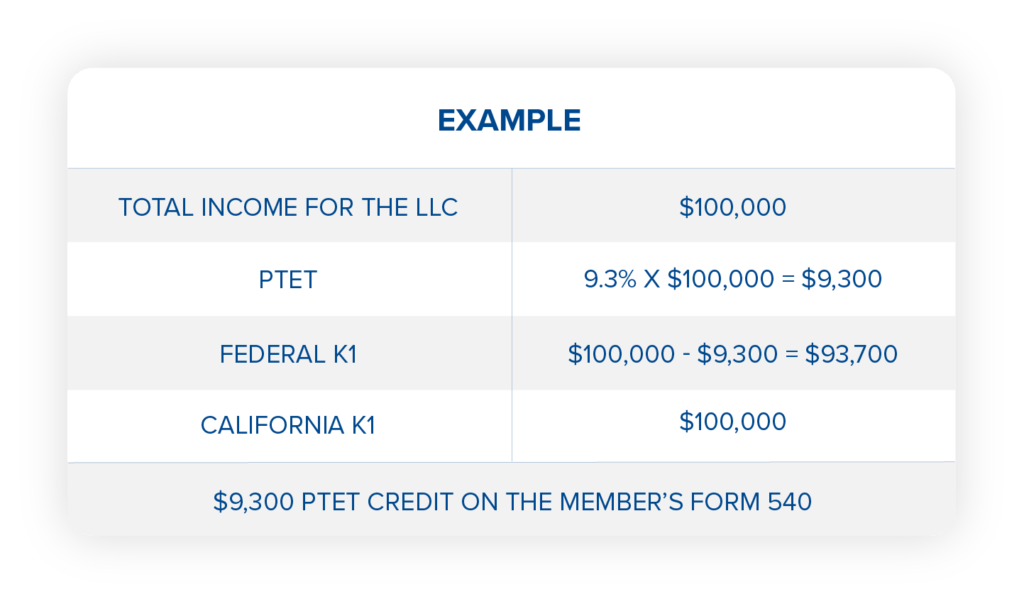

WHAT IS THE PTET PAYMENT?

The PTET payment is 9.3% of the qualified net income which is the sum of the pro rata share or distributive share of income subject to California personal income tax of each consenting partner, member, or shareholder. This means the share of income for non-consenting partners, members, or shareholder is excluded from the calculation.

This sounds great, however, what can go wrong?

As originally written in AB 150, the PTET credit does not reduce the amount of tax due below the tentative minimum tax (TMT). This can create a problem for many of our clients since the amount of their TMT will most likely be less than their regular CA tax. The excess credit is a nonrefundable credit and it is carried over five years. If there is still remaining credit after five years, it is lost.

Let's Talk About SB 113

On February 9, 2022, Governor Newsom signed SB 113, which includes the following changes retroactive to 2021:

- Repealing the tentative minimum tax limitation on the PTET Credit

- Allowing partnerships to be owners of partnerships, LLCs, or S corporation to claim the PTET Credit

- Allowing SMLLC that are pass-through entity owners to claim the PTET Credit

- Changing the credit ordering rules related to the PTET Credit to increase the benefit for taxpayers that claim the Other State Tax Credit beginning with the 2022 tax year.

The Governor also proposed expanding the PTET Credit by allowing disregarded entities such as SMLLCs. This was not included in SB 113.

The passage of SB 113 is welcome relief, but careful planning still needs to be done whether our clients should consent to the PTET or not.

Final Dates & Remarks

DEADLINE REMINDER: Elect taking advantage of the PTET credit for 2021 by March 15, 2022

Our PTE clients still have until March 15, 2022 to elect taking advantage of the PTET credit for 2021. Please note that the deduction will be taken on the 2022 K-1.

DEADLINE REMINDER: Payment must be made or the PTE cannot take advantage of the PTET Credit by June 15, 2022

For 2022, a payment needs to be made by June 15, 2022 to make the PTE election for 2022. If no payment is made by June 15, 2022, the PTE cannot take advantage of the PTET Credit.