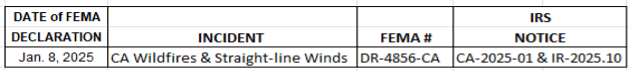

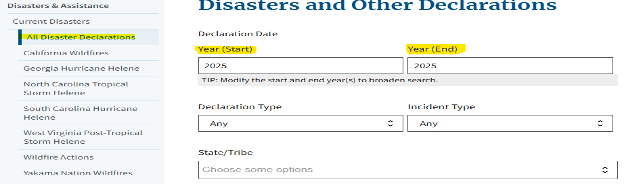

Federal Notices: CA-2025-01 & IR-2025-10

IRS notices CA-2025-01 and IR-2025-10, issued January 10th, announced California residents of Los Angeles County, identified by FEMA as a “federally declared disaster area” due to the recent fires and wind conditions now have until October 15, 2025, to file and pay various federal individual and business tax returns and payments.

This tax relief postpones until October 15, 2025, several tax filing and payment deadlines beginning on January 7, 2025, and eliminates any penalties or interest for payments made by the new deadline, October 15, 2025. See the exception below for payroll tax forms W-2 and W-3 and Form 1099-MISC and Form 1099-NEC (also known as information returns).

FEMA Disaster Declaration for California Residents & Businesses in Los Angeles County

NOTE: State of California Conforms to Most Federal Tax Relief, see below.

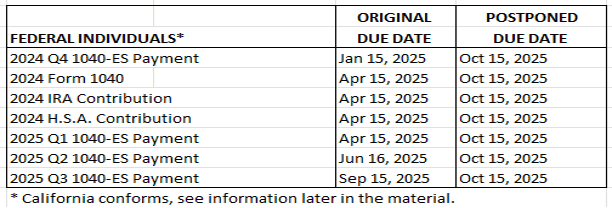

Individual Taxpayers

Tax year 2024 individual federal income tax returns originally due April 15, 2025 are now due October 15, 2025, for taxpayers in Los Angeles County. Other individual deadlines extended to October 15, 2025, include 2024 contributions to IRAs and health savings accounts. Individual quarterly estimated tax payments: 4th quarter 2024 originally due January 15, 2025, may now be paid by October 15, 2025, or with Form 1040 or Form 1040 extension, if filed and paid by October 15, 2025, and 1st, 2nd, and 3rd quarter 2025 quarterly estimated tax, originally due April 15, June 15, and September 15, respectively, may also be paid by October 15, 2025, without penalty or interest.

Note: Taxpayers and business entities whose address of record is Los Angeles County are automatically eligible for postponement, whether or not they are directly affected by the fires. See below for other eligible taxpayers.

Business Taxpayers

This IRS disaster relief, under section 7508A, also applies to many business tax returns. Business taxpayers in Los Angeles County now have until October 15, 2025, to file most business tax returns including employment tax returns, C corporation, S corporation, partnership, LLC tax returns filing as partnerships or other entities, non-profit, trust, estate, gift, generation-skipping transfer tax, and Form 5500 series returns that have either an original or extended due date occurring on or after January 7, 2025, and before October 15, 2025.

Federal tax payments related to any of the above business or other tax filings originally due on or after January 7, 2025, and before October 15, 2025, are postponed through October 15, 2025, and will not be subject to interest or penalties for failure to pay as long as such payments are paid on or before October 15, 2025.

Business Income Tax, Estate, Trust, Gift, and Other Tax Filings

NOTE: California PTET payment due March 15, 2025, and the June 15, 2025 opt-in payments are now postponed until October 15, 2025.

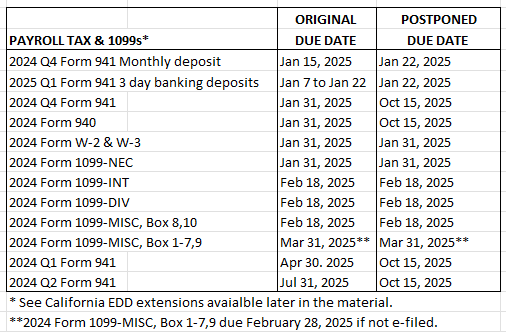

Payroll Tax and Form 1099-NEC & Form 1099-MISC

IR-2025-10 states “The October 15, 2025, deadline also applies to the quarterly payroll and excise tax returns normally due on January 31, April 30, and July 31, 2025. In addition, penalties on payroll and excise tax deposits due on or after January 7, 2025, and before January 22, 2025, will be abated as long as the tax deposits are made by January 22, 2025.”

No Postponement for Forms W-2 & W-3, Forms 1099-NEC, and Other Form 1099-Series

Year-end tax filing obligations, namely W2s and 1099s are not listed in Rev. Proc. 2018-58 as eligible for postponement. And CA-2025-01 states “the postponement of time to file and pay does not apply to information returns in the W-2, 1094, 1095, 1097, 1098 or 1099 series; Forms 1042-S, 3921, 3922 or 8027; or employment and excise tax deposits.”

However, CA-2025-01 agrees with IR-2025-10 and also states “In addition, penalties on payroll and excise tax deposits due on or after January 7, 2025, and before January 22, 2025, will be abated as long as the tax deposits are made by January 22, 2025.” This includes any applicable interest charged on these payments which are eligible for the January 22, 2025 postponement.

Payroll Tax, Form 1099s & Tax Filings

Employer Pension Funding Postponement Available to Oct 15

Though the IRS California disaster notices specifically mentioned the postponement for timely filing of IRA and HSA payments for tax year 2024 to October 15, 2025, employer pension contributions were not mentioned. See our excerpt from I.R.C. § 7508A(b), below, for regs on the employer funding postponement. Also check with your pension administrator.

I.R.C. § 7508A(b) Special Rules Regarding Pensions, Etc. —

In the case of a pension or other employee benefit plan, or any sponsor, administrator, participant, beneficiary, or other person with respect to such plan, affected by a disaster, fire, or action described in subsection (a), the Secretary may specify a period of up to 1 year which may be disregarded in determining the date by which any action is required or permitted to be completed under this title. No plan shall be treated as failing to be operated in accordance with the terms of the plan solely as the result of disregarding any period by reason of the preceding sentence.

Tax Deferred Exchange (§1031) and Other Federal Tax & Time Sensitive Deadlines

The IRS also gives affected taxpayers until October 15, 2025, to perform other time-sensitive actions described in Treas. Reg. § 301.7508A-1(c)(1) and Rev. Proc. 2018-58, 2018-50 IRB 990 (December 10, 2018), that are due to be performed on or after January 7, 2025, and before October 15, 2025. Rev. Proc. 2018-58, 139 pages, consists primarily of lists of all actions eligible for postponement related to a federally declared disaster, such as 1031 exchange (see Section 6 and Section 17), S corporation elections, tax court and bankruptcy deadlines, etc.

Federal Penalties & Interest

I.R.C. § 7508A(a) grants the authority for the Secretary of Treasury & IRS to waive “the amount of any interest, penalty, additional amount, or addition to the tax for periods after such date” of declaration.

If an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated.

IRS Collections and Audits

Affected taxpayers who are contacted by the IRS on a collection or examination matter should explain how the disaster impacts them so that the IRS can provide appropriate consideration to their case.

Determining Eligible Taxpayers & Businesses

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area, in this case Los Angeles County, whether or not the taxpayer incurred any actual loss or damages related to the disaster. Therefore, taxpayers who’s individual and business tax returns have an L.A. County address do not need to contact the IRS to get this relief.

In addition, all relief workers affiliated with a recognized government or philanthropic organization assisting in the relief activities in the covered disaster area and any individual visiting the covered disaster area who was killed or injured as a result of the disaster are entitled to relief but may have to contact the IRS to have their account flagged as eligible. Taxpayers qualifying for relief who live outside the disaster area may contact the IRS at 866-562-5227 to notify the IRS of the applicable issues.

Tax Practitioners within Los Angeles County Provide Relief to Taxpayers

Taxpayers not in the covered disaster area, but whose records necessary to meet a deadline listed in Treas. Reg. § 301.7508A-1(c) are in the covered disaster area, are also entitled to relief. For example, the taxpayer’s tax practitioner’s office, if located within the declared county, provides relief to the taxpayer. Taxpayers qualifying for relief who live outside the disaster area may contact the IRS at 866-562-5227 to notify the IRS of the applicable issues.

Contacting the IRS to Establish Relief for Out of Area Taxpayers

Several matters provide filing, paying, and penalty relief for out-of-area taxpayers including:

- Taxpayers working or volunteering for the disaster efforts

- Taxpayers visiting the area who are killed or injured

- Taxpayers whose tax practitioner is in the disaster area

- Individuals whose business in in the disaster area

- Businesses whose owners or operators reside in the disaster area

- Individuals or entities waiting on K-1s from entities in the disaster area

- Other applicable facts and circumstances related to the disaster area

NOTE: in many of these cases the taxpayer does not have to indicate they were personally affected by the disaster if one of the above conditions exist.

Our team has contacted the IRS at the federal disaster Tax Hotline number above, 1-866-562-5227. There is a very short wait time to speak to an IRS staff member and they are very experienced on these matters and quite helpful.

If the tax practitioner calls for the taxpayer or business, they either need Form 2848 on file or be prepared to fax the form to the IRS personnel on the call. And they may request that the SSN or EIN of the taxpayer client be “flagged” in the IRS computer as eligible for the disaster relief postponement. For the January 2025 Los Angeles County fire and wind disaster relief related to IR-2025-10 or CA-2025-01 be prepared to tell them the FEMA number DR-4856-DR listed at the top of this memo related to the disaster.

The IRS agent we spoke to indicated no further substantiation would be required, such as proving the taxpayer or the tax preparer’s office was struggling with specific fire or wind damage.

If the taxpayer calls on their own behalf to have their individual or business IRS account flagged for disaster relief, they should be prepared to give the applicable SSN or EIN for the taxpayer or business in Los Angeles County which provides them relief, and the county and zip code of the tax preparer’s office, or other affiliated business for which they are claiming related relief, and the FEMA number DR-4856-DR listed at the top of this notice. Note, they do not need to know the tax practitioner’s PTIN or EIN, if using that issue for relief but they need to know the tax practitioner’s zip code.

Additional Tax Relief for Federal Disasters

Business or individual taxpayers who are unable to meet the new expanded postponement deadline of October 15, 2025, due to specific circumstances related to this federally declared disaster may also request additional penalty abatement from the IRS for reasonable cause.

State of California Tax Relief Related to Los Angeles County Winds & Fires

California Franchise Tax Board Notice of Tax Filing Relief Postponement

California announced on January 11, 2025, that taxpayers in Los Angeles County will be granted a postponement to October 15, 2025, to file 2024 California tax returns and make any tax payments that would have been due January 7, 2025, through October 15, 2025. This aligns with the federal postponements granted for residents and businesses located in Los Angeles County and other taxpayers directly affected by the January 2025 California wildfires and wind damage.

The California Franchise Tax Board postponement includes the following:

- Individuals whose tax returns and payments are normally due on April 15, 2025.

- Quarterly estimated tax payments normally due on January 15, April 15, June 15, and September 15, 2025.

- Business entities whose corporate or pass-through entity tax returns are normally due on March 15 and April 15, 2025.

- Pass-through entity (PTE) elective tax payments normally due on March 15 and June 15, 2025.

- Tax-exempt organization returns normally due on May 15, 2025.

California Unemployment Benefits for Individuals Affected by L.A. County Fires

California has waived the one-week waiting period for workers who qualify for regular unemployment benefits and are affected by the January 2025 Los Angeles County fires, including the Palisades, Eaton, Hurst, Woodley, and Lidia fires.

California Property Tax Payment Postponement & Property Tax Reassessment Relief

Governor Newsom’s January 16, 2025, executive order announced two new relief measures:

• Automatic Extension of Property Tax Payments for Designated Zip Codes:

Property owners in designated areas now have automatic extensions for property tax payments. Property taxes due April 10, 2025, and December 10, 2025, are now due April 10, 2026.

The executive order provides blanket relief of property tax deadlines for property owners in fifteen specific Los Angeles County ZIP codes: 90019, 90041, 90049, 90066, 90265, 90272, 90290, 90402, 91001, 91040, 91104, 91106, 91107, 93535, and 93536. Within these areas, property tax payment deadlines have been extended to April 10, 2026, with no penalties or interest accruing during this period. This extension applies automatically, requiring no application or special filing.

Comment: The April 10, 2026 deadline creates a big financial challenge: property owners will face three property tax installments due simultaneously, coinciding with federal and state tax returns and first quarter estimated tax payments due five days later. This concentration of tax bills will create cash flow problems for many taxpayers. Warn your clients taking advantage of the payment delay.

Tax planning. For business and rental property owners, the property tax delay will impact their 2025 deductions. Evaluate paying the 2024 property taxes December 2025 versus the value of using the money if the payments are delayed until April 2026. For individuals, the 2025 SALT limit is likely to make a 2025 property tax payments worthless. And there is some possibility that the SALT limit will be higher with the negotiations around TCJA’s expiration. Paying in 2026 is the best bet for the moment.

• Taxpayers May Apply to Reduce Property Taxes for Damaged/ Destroyed Property:

For property owners who had their property damaged or destroyed, the disaster reassessment program can provide immediate reductions to property tax assessments. While the postponement of payments to April 10, 2026, helps, it’s even better if the amounts due in 2026 can be reduced.

Comment. Reassessment is available for more than federally declared disasters. If your client has a fire in their home or flood damage to their rental property, the client should be advised to contact their County Assessor for possible relief on property taxes.

Example. Holly had a house fire. The house had little visible damage from the street, but asbestos clean up meant the house was unlivable for 11 months. The application for reassessment meant that improvements were reduced to zero until inspectors cleared the house for occupancy. It was an easy application process and getting a little thing done was good for Holly.

California Taxpayers Owing Past Due Taxes Prior to January 7, 2025

California Franchise Tax Board will stop accrual of interest during the time they delay mailing of bills and notices as a result of disasters declared by the President or the Governor of California.

At this time California has not indicated they will be suspending collection activity for amounts owing prior to January 7, 2025, however affected taxpayers unable to make their regularly schedule payments on existing payment plans may be eligible to have interest on the past due amounts suspended if they make a request.

California taxpayers must submit a request by submitting Form FTB3701, Request for Abatement of Interests, to stop accruing interest on taxes owed to California. The form may be submitted by fax to 1-916-843-6022, or email to FTBAdvocate@ftb.ca.gov or by mail to the following address:

Executive and Advocate Services MS A381

Franchise Tax Board

PO Box 157

Sacramento CA 95741-0157

State of California Resources for Disasters

- https://www.ftb.ca.gov/file/business/deductions/disaster-loss.html#Extended-deadlines-to-file-pay-and-make-contributions

- https://www.gov.ca.gov/2025/01/11/california-provides-tax-relief-for-those-affected-by-los-angeles-wildfires

California Employer Payroll Tax Filings and Payments

California Employment Development Department (EDD)

(https://edd.ca.gov/en/About_EDD/Disaster_Related_Services)

Employers affected by the January 2025 Los Angeles County or the Ventura County fires may request up to a 60-day extension to file their state payroll tax reports or deposit payroll taxes. The request must be submitted within 60 days of the original due date of the payroll tax forms or payments and will eliminate any penalties and interest on payments made by the extended due date.

An employer’s payroll tax filing and paying 60-day extension request may be submitted by written request, there is no specific form available, or requested by phone at 1-888-745-3886.

Employers must provide the following:

- The extension of time being requested.

- The specific quarter for which the extension is requested.

- Information regarding why the reports or payments could not be submitted in the original time frame.

Written requests for an EDD extension can be mailed to:

Employment Development Department

PO Box 826880

Sacramento, CA 94280-0001

California Sales Tax (California Department of Tax and Fee Administration: CDTFA)

Automatic Sales Tax Return Postponement for Los Angeles County: In response to the recent wildfires, the state has extended the January 31, 2025, sales and use tax filing deadline for Los Angeles County taxpayers until April 30, 2025.

Other CDTFA Reporting Administered Programs: Filing and Taxes Due

An extension of up to three months to file and pay taxes or fees is available for most other CDTFA administered programs, similar to the sales and use tax postponement.

This relief for other CDTFA programs is offered to any taxpayer directly affected by the Los Angeles and Ventura County Wind and Fire disasters, and who, as a result, cannot meet their filing and payment deadlines. The CDTFA may also extend the deadline for filings that were delayed by disruption of service from the United States Postal Service or private mail and freight companies. Businesses impacted by the L.A. County fires but with an address outside of L.A. County are also eligible to request a postponement.

CDTFA Relief Request of Interest and Penalties

Relief from interest and penalties may be provided to people who are unable to file their returns and pay taxes and fees when due. To request a filing or payment extension or relief from interest and penalties, please make a relief request directly with CDTFA.

Requests for relief may be made by completing and submitting CDTFA-735, Request for Relief from Penalty, Collection Cost Recovery Fee, and/or Interest form, or applying online through the taxpayer’s online CDTFA account.

To apply online, log in to the business’s CDTFA account and select “More” under “I want to” then select Submit a Relief Request. Occasionally, the option to submit a relief request does not pop up when searching for it, in which case the taxpayer should call the support number on the website to access the online request.

Note: References to Ventura County in EDD & CDTFA Relief

California EDD and CDTFA available extension requests also reference the County of Ventura. These references are related to a November 2024 fire in Ventura County, whose employers and businesses may still be eligible for payroll tax or sales tax postponements related to that fire.

Preparing Tax Returns for L.A. County Fire Victims

Reporting Casualty Losses After TCJA

Generally, for tax years 2018 through 2025, individuals who incur losses of personal-use property from fire, storm, flood, shipwreck, or other casualty, or theft are not able to deduct the losses unless the loss is attributable to a federally declared disaster.

However, businesses, rentals, and other income producing property are eligible for applicable business tax deductions related to theft or damage of business property or assets whether or not attributable to a federally declared disaster.

Tax Note: Theft losses incurred by individuals in a transaction entered into for profit may still be deductible as are most Ponzi losses.

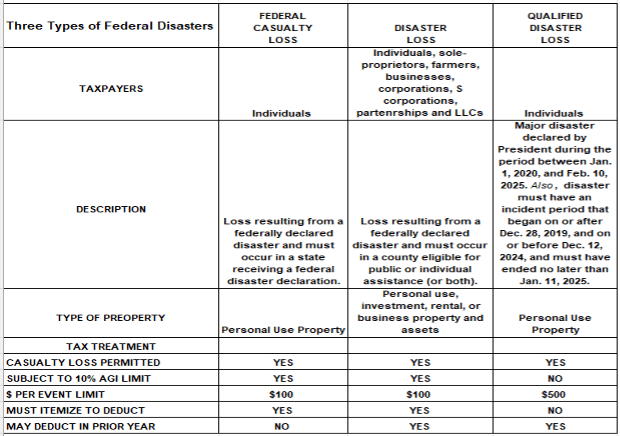

The three types of loss related to federally declared disasters are:

- Federal Casualty Loss

- Disaster Loss

- Qualified Disaster Loss

All federally declared disasters are a disaster determined by the President of the United States to warrant assistance by the federal government under the Stafford Act. Federally declared disasters include: [1]

(a) a major disaster declaration (FEMA letters DR), or

(b) an emergency declaration (FEMA letters EM) under the Stafford Act.

CHART: Types of Losses Related to Federally Declared Disasters

There are three types of losses related to federally declared disasters, and each has different requirements for deducting any applicable losses. [2]

1) Federal Casualty Loss

A federal casualty loss is an individual’s casualty or theft loss of personal-use property that is attributable to a federally declared disaster. The casualty loss must occur in a state receiving a federal disaster declaration. If they suffered a casualty or theft loss of personal-use property that was not attributable to a federally declared disaster, it is not a federal casualty loss, and a casualty loss deduction may not be claimed unless the exception applies.

Tax Treatment of a Federal Casualty Loss

Taxpayers who suffer a federal casualty loss are eligible to claim a casualty loss deduction.

2) Disaster Loss

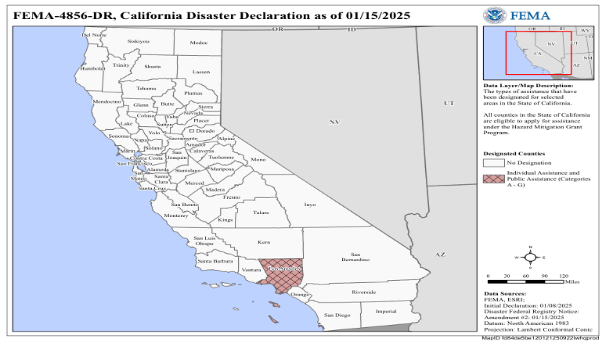

A disaster loss is a loss that is attributable to a federally declared disaster and that occurs in an area eligible for assistance pursuant to the Presidential declaration. The disaster loss must occur in a county eligible for public or individual assistance (or both). Disaster losses are not limited to individual personal-use property and may be claimed for individual business or income-producing property and by corporations, S corporations, and partnerships.

Tax Treatment of a Disaster Loss

If the taxpayer suffers a disaster loss, they are eligible to:

- Claim a casualty loss deduction and

- To elect to claim the loss in the preceding tax year.

3) Qualified Disaster Losses

A qualified disaster loss also includes an individual’s casualty or theft loss of personal-use property that is attributable to:

- A major disaster declared by the President in 2016 under the Stafford Act;

- Hurricane Harvey;

- Tropical Storm Harvey;

- Hurricane Irma;

- Hurricane Maria;

- The California wildfires in 2017 and January 2018;

- A major disaster that was declared by the President under the Stafford Act and that occurred in 2018 and before December 21, 2019, and continued no later than January 19, 2020 (except those attributable to the California wildfires in January 2018 that received prior relief).

- A major disaster that was declared by the President during the period between January 1, 2020, and February 10, 2025. Also, this disaster must have an incident period that began on or after December 28, 2019, and on or before December 12, 2024, and must have ended no later than January 11, 2025.

Tax treatment of Qualified Disaster Losses

Taxpayers who suffer a qualified disaster loss are eligible to:

- Claim a casualty loss deduction,

- To elect to claim the loss in the preceding tax year,

- Ignore 10% AGI limit but subject to $500 per event limit and

- To deduct the loss without itemizing other deductions on Form 1040, Schedule A.

CALIFORNIA LOS ANGELES COUNTY 2025 FIRES TAX NOTE:

Currently taxpayers in California’s Los Angeles County who suffer losses in the January 2025 fires are only eligible for Disaster Loss tax treatment, not Qualified Disaster Loss tax treatment due to the fact that eligible deadlines extended by the Federal Taxpayer Disaster Relief Act of 2023 do not support the applicable dates for the 2025 Los Angeles County fires.

At the time this material was prepared the California Los Angeles County fire disaster DM-4586 does not currently qualify as a Qualified Disaster Loss because the incident period for the LA County fires did not begin on or before December 12, 2024, nor had the period ended by January 11, 2025. However, we do expect further legislation shortly to extend the eligible dates for a Qualified Disaster Loss.

Until further guidance or additional legislation is enacted Los Angeles County 2025 fire victims may deduct a casualty loss and may elect to deduct it on the previous year’s tax return, 2024, but the loss will be subject to the 10% AGI limitation and the deduction will only be available to taxpayers who itemize their deductions. [3]

Identifying Type of Disasters for the Purpose of Determining Eligible Tax Treatment

A FEMA disaster declaration number may begin with:

- “DR” and four numbers for a federally declared major disaster declaration, or

- “EM” and four numbers for a federally declared emergency declaration, or

- “FM” and four numbers for a federally declared fire management assistance grant.

STEPS TO DETERMINE ELIGIBLE TAX TREATMENT FOR DISASTER EVENTS:

- We would look for federally declared disasters with beginning letters in the FEMA code of “DR” or “EM”

- Federally declared disasters with the beginning FEMA code of “EM” will generally be eligible for either the Federal Casualty Loss deduction or the Disaster Loss tax treatment, depending on the taxpayer’s county of residence, or rental property, or business. And we may need to click on the FEMA link to determine if the taxpayer was in an area which was eligible to receive federal assistance. (See DR-4586, below)

- Federally declared disasters with the beginning FEMA code of “DR” may be eligible for Qualified Disaster Loss tax treatment so we would then look at the “Incident Period” indicated for an applicable event and the date the disaster was declared to determine if those dates meet the dates in the last bullet point of the list earlier for Qualifying Federal Disasters. Both the incident period and the date the disaster declaration was made are shown with the FEMA code on the FEMA website.

- We would ignore any with the code FM, for fire management because that designation is not considered a federally declared disaster for tax purposes.

FEMA Website for Finding Federal Disaster Declarations

Tax note: Details from FEMA Website to Determine Eligible Tax Treatment

See the right margin of the map which indicates that the shaded area representing Los Angeles County is eligible for individual and public assistance which would make losses sustained based on this event eligible for Disaster Loss tax treatment.

However, the Incident Period: “January 7, 2025, and continuing” falls outside the permitted incident period for a Qualified Disaster Loss at this time, even though the date the disaster was declared, January 8, 2025, is within the range for a Qualified Disaster Loss.

Filing a Tax Return to Claim Disaster Loss Related to a Federally Declared Disaster

Personal casualty and theft losses attributable to a federally declared disaster are subject to the $100 per casualty and 10% of adjusted gross income (AGI) reductions unless they are attributable to a qualified disaster loss.

Taxpayers can deduct qualified disaster losses without itemizing other deductions on Schedule A. And their net casualty loss from these qualified disasters doesn’t need to exceed 10% of adjusted gross income (AGI) to qualify for the deduction, but the $100 limit per casualty is increased to $500.

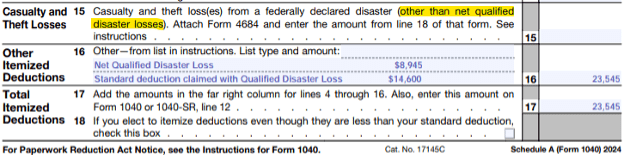

Increased standard deduction reporting for Qualified Disaster Losses

If the taxpayer has a net qualified disaster loss and isn’t itemizing their deductions, they can claim an increased standard deduction using Form 1040, Schedule A

- Enter the amount from Form 4684, line 15, on the dotted line next to line 16 on Schedule A and the description “Net Qualified Disaster Loss.”

- Also, enter on the dotted line next to line 16 of Schedule A the standard deduction amount and the description “Standard Deduction Claimed With Qualified Disaster Loss.”

- Combine these two amounts and enter the total in the entry space on line 16 of Schedule A

Schedule A with Qualifying Disaster Loss

Disaster Year for Reporting Purposes

The disaster year is the latter of:

- Tax year in which the loss attributable to a federally declared disaster was sustained or

- Tax year in which it is determined that no further claim for reimbursement exists

For example, if a claim for reimbursement exists for which there is a reasonable prospect of recovery, no part of the loss for which reimbursement may be received is sustained until it can be ascertained with reasonable certainty whether the taxpayer will be reimbursed.

Example: Disaster Year Considered to be Year of Final Reimbursement

In December 2023, the taxpayer’s vehicle was destroyed in severe flooding that occurred in the area where they live. The area was designated by FEMA to be eligible for public or individual assistance (or both). They immediately filed a claim for reimbursement with their insurance company. There was a reasonable prospect that they would recover the full amount of the loss. The claim was settled in January 2024 when the insurance company reimbursed only half of the loss. The disaster year is 2024 (not 2023 when the loss occurred). The loss was considered sustained in 2024 because that’s when it became reasonably certain whether they would be reimbursed. The taxpayer may either deduct the unreimbursed loss on their tax return for the disaster year (2024) or make an election to deduct the unreimbursed loss on their tax return for the preceding year (2023).

Claim the Loss in the Year of Loss or the Preceding Tax Year

Both an eligible Disaster Loss and a Qualifying Disaster Loss permit an election for the taxpayer to choose to claim the loss on either the return for the year the loss occurred (for 2025 disasters, the 2025 return normally filed next year), or the return for the prior year (the 2024 return filed in 2025). For individual taxpayers, the deadline for making this election for a 2025 loss is Oct. 15, 2026. (See the section on Tax Year of Loss, earlier in the material.)

Taxpayers who incur or determine the applicable amount of a 2025 Disaster Loss or a Qualified Disaster Loss after filing their 2024 taxes may elect to deduct that loss on their amended 2024 return for the tax year immediately preceding the disaster year. If this election is made, the loss is treated as having occurred in the preceding year.

This election may be made on Form 4684 Casualties and Thefts, Section D. This election should be attached to an original return or amended return for the preceding year. The election to claim the disaster loss in the preceding year must be made on or before the date that is 6 months after the regular due date for filing the original return (without extensions) for the disaster year. See Publication 547 for more information.

If a taxpayer chooses to deduct a disaster loss sustained in the disaster year on an original or on an amended return for the preceding year, the taxpayer must report all related losses that qualify for the election on the preceding year return. Splitting the deductions between years is not permitted.[4]

IRS Processing of Amended Returns to Claim a Disaster Loss

A taxpayer may claim a casualty loss deduction on an amended or original return. A casualty loss must be reduced by the amount of insurance proceeds and other reimbursements received.

The IRS expedites processing of amended returns notated with the appropriate disaster information, on the top of page one of Form 1040-X, i.e., “Helene Hurricane.” The indicates the timeframe is generally 60 days.

[1] Pub. 547, Casualties, Disasters, and Thefts, Draft Jan. 2, 2025

[2] Instructions for Form 4684, Draft Jan. 13, 2025

[3] H.R. 5863 Federal Disaster Tax Relief Act of 2023

[4] § 1.165-11(c)

Recent Stories

Next Up...

- |

- TaxByte