Why Trusts Can Be Residents of More Than One State

California has 39 million people, according to the census. (I suspect at least 10 million of those folks are employed by the Franchise Tax Board.) The United States has 335 million people. Doing the math, there is a likelihood that if you have an irrevocable trust on the west coast, someone out there is going to ruin your tax professional’s day.

so let me get this straight.

— Andrea Carr CPA (@andreacpa0) February 15, 2024

you can have a trust established in hawaii, holding hawaii real estate and the sole beneficiary is a resident of hawaii, but because the sole fiduciary is a california resident, the whole trust is a california resident subject to california taxes?

Time to burst that bubble. Trusts can be residents of more than one state. “How is that possible,” you say?

“This is a crime against tax laws!” you say.

“I’m calling the President right now to give him a piece of my mind!” you say.

Well, put down the phone. For one thing, he hasn’t been answering my calls, so I’m not sure yours are going to get through. For another thing, all the states determine the residency of a trust in a different way. And I’m not sure the Federal government has much say over that.

Example Tax Troublemakers: California and New York

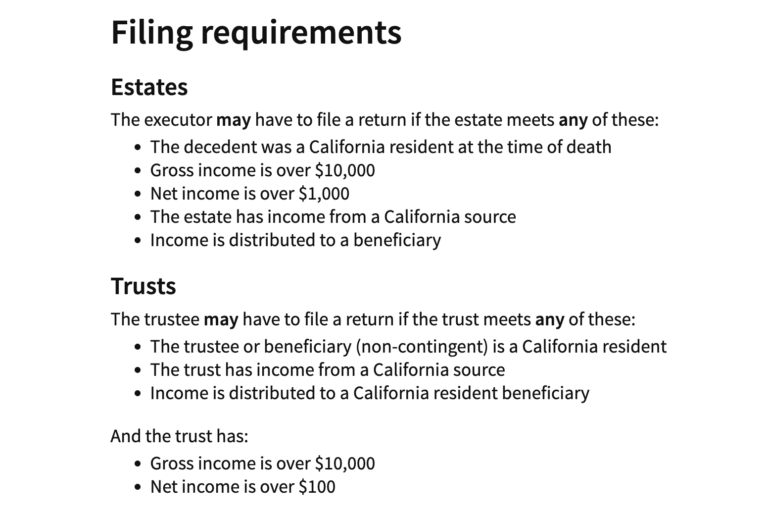

The two off the top of my head—although there are more—are California and New York, the two top tax troublemakers. One of the gotchas for New York is that if the trust was created under the will of a New York decedent, that’s a New York trust! Congratulations. You might not have to report income there, but you do have a filing obligation. For California, here’s a lovely snippet of the rules…

That’s right: Your trustee or any of your (non-contingent) beneficiaries being California residents pulls that trust right into California’s clutches. You don’t even need California source income! You don’t even need to make distributions! And if you have one resident and one non-resident trustee? I hope you enjoy math. And if you have one California resident beneficiary and the rest are… well… non-residents, even more math. Let’s just say that some Excel schedules have been created in the pursuit of determining how much income is really taxable to California. But, if your sole and lone trustee is a California resident? Boom, California resident trust.

What does this mean for tax preparers?

All hope is not lost! Don’t cry for me Argentina! Love Will Keep Us Alive!

There are some things that you can do if you find yourself in the FTB’s “graces”.

Change fiduciaries to a non-California resident.

Now, don’t try to be clever and change to a fiduciary that SAYS they’re based out of Omaha, Nebraska, but does all of the trust’s work in California, because that will still be considered a California trustee.

There are loads of lovely professional trustees that live in states that are NOT California.

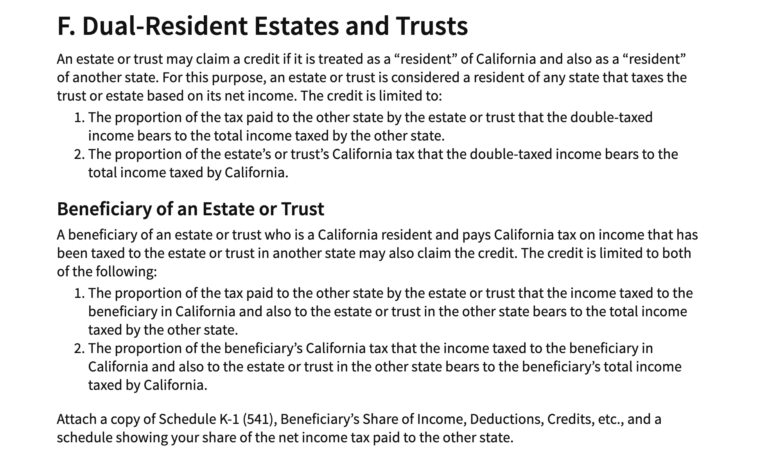

If you love your trustee—despite the fact that they live in California and just made your tax professional cry—you can also request a credit for the taxes paid in the other state of residency. This goes on Schedule S.

Trustees: Make Sure to Get Annual W-9s from Beneficiaries

Ask for those W-9s! This is another reason to make sure that your trust clients (or if you’re a trustee then you can do this) get a W-9 from their beneficiaries on an annual basis. Remember, you don’t even need to make distributions to have the trust taxed in California! And beneficiaries are folks on the move. At least 1 person in that 39 million HAS to have moved to LA in the last year in order to peruse their movie-star dreams. Oh, and also is a beneficiary of a trust. And now, if you’ll please excuse me, I have to go file an extension on a fiscal-year California estate/trust.

STAY TUNED

Stay updated with more breaking tax-related developments by subscribing to Tax Bytes with Jessica Jeane, J.D.