Explore Western CPE

Whether it’s on-demand digital courses or live events at world-class resorts, expect to get more from your CPE than ever before.

Tax Updates:

Get Ahead of Tax Season

Digital CPE Courses:

Build Your Skills Like a Pro

Live Learning Events:

Enhance your CPE Experience

CPE For Business:

Tailor Training for Your Team

-

Taxes

Taxes

2024 California Federal Tax Update (Complete Edition)

Webcast

Credits: 20 $784.00

Webcast

Credits: 20 $784.00$784.00Original price was: $784.00.$509.00Current price is: $509.00. -

Taxes

Taxes

2024 Federal Tax Update (Complete Edition) + FlexCast

Webcast

Credits: 16 $882.00

Webcast

Credits: 16 $882.00$882.00Original price was: $882.00.$683.00Current price is: $683.00. -

Taxes

Taxes

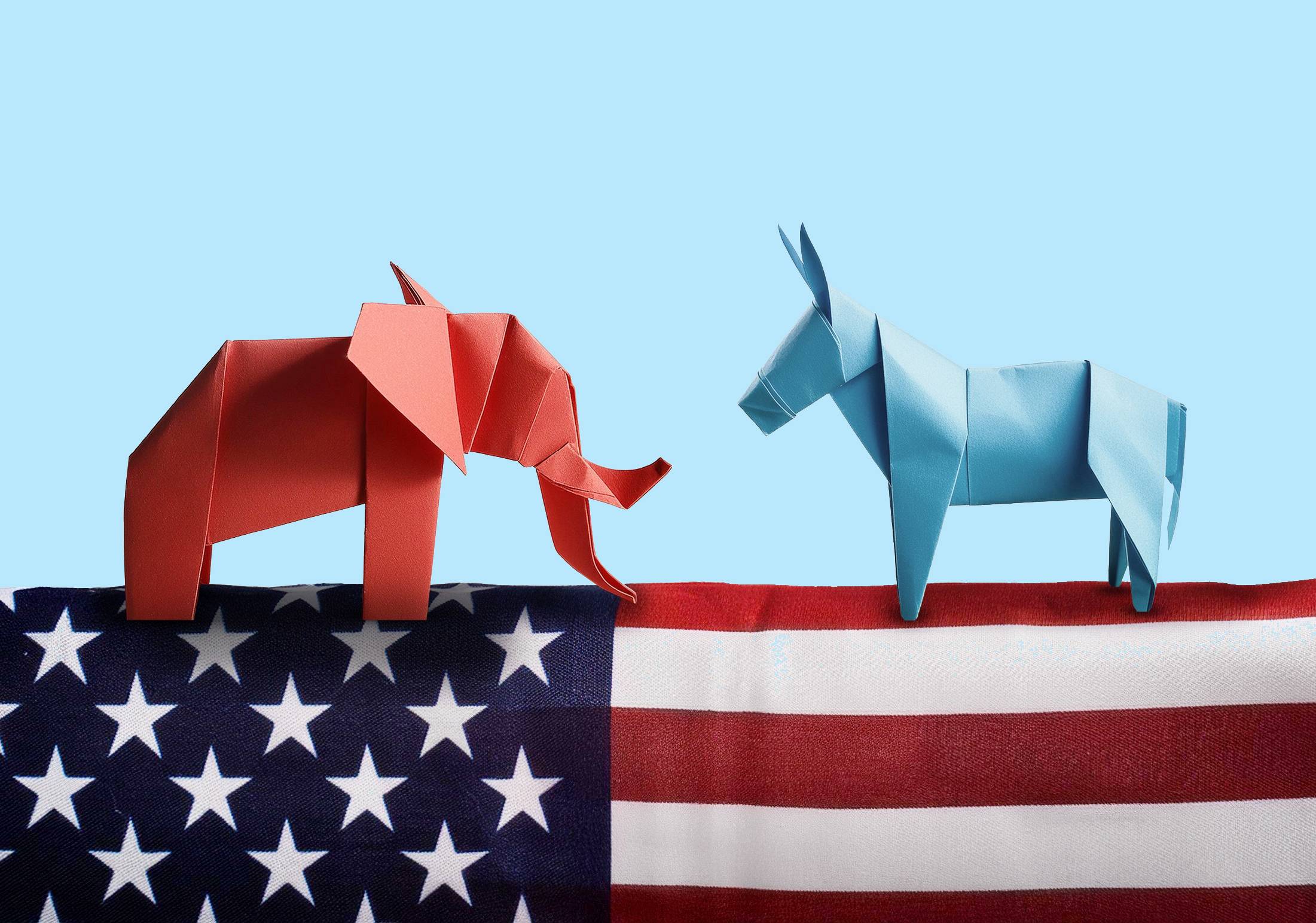

Tax at the Ballot Box: Part 2

Russell W. Sullivan& Sharon Kreider, CPA Live Webcast

Credits: 2 $29.00

Live Webcast

Credits: 2 $29.00$29.00

-

Accounting

Accounting

How to Develop Your System of Quality Management Using the AICPA Practice Aids

Jeff Sailor, CPA Webcast

Credits: 3 $147.00

Webcast

Credits: 3 $147.00$147.00

-

Business Management & Organization

Business Management & Organization

Retail Management

Steven M. Bragg, CPA QAS Self-Study

Credits: 14 $364.00

QAS Self-Study

Credits: 14 $364.00$364.00 – $404.00

-

Taxes

Taxes

Special Problems in Real Estate Taxation

Danny Santucci, JD QAS Self-Study

Credits: 11 $308.00

QAS Self-Study

Credits: 11 $308.00$308.00 – $348.00

-

Finance

Finance

Mergers and Acquisitions

Steven M. Bragg, CPA QAS Self-Study

Credits: 19 $399.00

QAS Self-Study

Credits: 19 $399.00$399.00 – $439.00

-

Taxes

Taxes

Rental Properties, with Deep Dive into Short-term Rentals

A.J. Reynolds, EA Webcast

Credits: 2 $98.00

Webcast

Credits: 2 $98.00$98.00

-

Taxes

Taxes

SECURE 2.0 Act: Know the Changes to IRA, 401(k), Roth, & Other Retirement Plans

Robert Keebler, CPA, AEP, MST, CGMA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00Original price was: $49.00.$38.00Current price is: $38.00.

1M+

Certificates Issued

900+

COURSES

3.5k+

Cpe Credits

20K+

Live attendees

SUPPORTED BY:

GROUP DISCOUNTS

Western CPE for Business

Western CPE for Business is a smarter strategy to drive real CPE transformation. Upskill your teams, improve retention and satisfaction, and get a real ROI on your continuing education.

Celebrating the life of

September 25, 1943 – May 14, 2024

In lieu of flowers, the family requests donations be made to the University of Montana Foundation and noted for the “Vern Hoven, CPA Endowed Accounting Scholarship”.

Checks should be mailed to The UM Foundation, PO Box 7159, Missoula, MT 59807-7159 or online at www.SupportUM.org and designate the gift to the “Vern Hoven, CPA Endowed Accounting Scholarship”.