Webcast

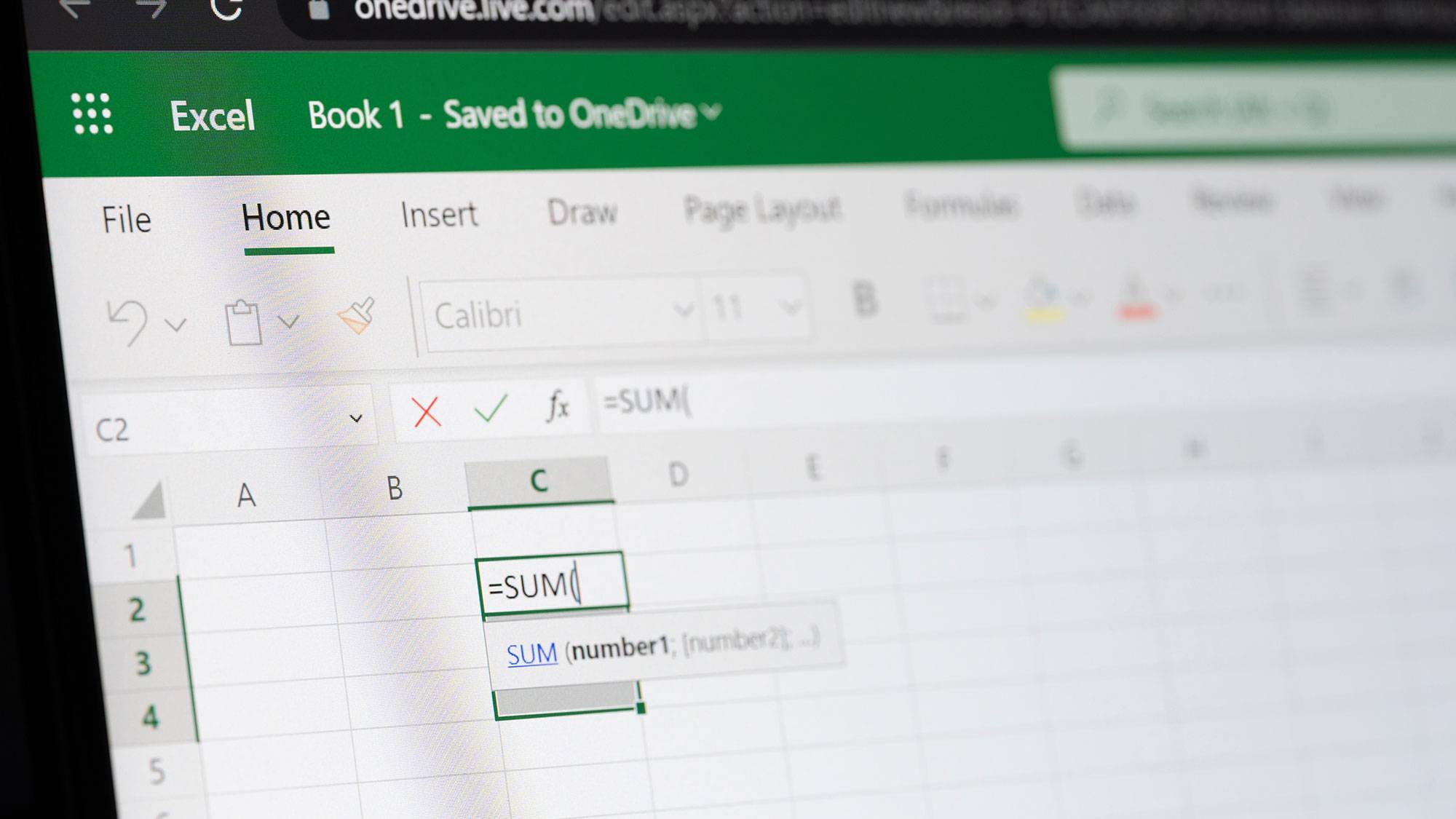

Excel Essentials for Staff Accountants

Learn advanced Excel skills, including PivotTables, formulas, and reporting, with hands-on practice.

$392.00

Webcasts are available for viewing Monday – Saturday, 8am – 8pm ET.

Without FlexCast, you must start with enough time to finish. (1 Hr/Credit)

Please fill out the form below and we will reach out as soon as possible.

CPE Credits

8 Credits: Computer Software & Applications

Course Level

Intermediate

Format

Webcast

Course Description

Staff accountants have specific needs when working with Excel. Unfortunately, their existing Excel knowledge often does not meet these needs. Chief among these are summarizing data quickly and accurately, generating accurate and aesthetically pleasing reports, and creating accounting-centric calculations for elements such as depreciation, amortization, and interest. By participating in this eight-hour session, staff accountants will gain the essential skills to maximize efficiency and accuracy when working with Excel.

Excel Essentials for Staff Accountants begins with a quick overview of Excel best practices. It then progresses rapidly into discussions that address PivotTables, sophisticated formulas, Tables, formatting, and working with dates in Excel. Throughout the Excel for accountants CPE, you will learn from accounting-centric examples to reinforce key learning points. In this Excel CPE for CPAs course, you will learn in a “laptop-friendly” environment, and participants will have access to all the demonstration files. In sum, this seminar is a “must” for all staff accountants seeking to improve their efficiency and accuracy when working with Excel.

Learning Objectives

Upon completing this course, you should be able to:

- List five critical best practices associated with creating workbooks and constructing workbooks that comply with these principles

- Utilize PivotTables and PivotCharts to quickly summarize and present data without generating formulas

- Build sophisticated formulas to assist with reporting and analysis, including those that use functions such as VLOOKUP, XLOOKUP, SUMIFS, CHOOSE, XNPV, XIRR, PMT, IPMT, ACCRINT, and TRIM

- Create Tables from ranges of Excel data and identify the primary advantages of working with Tables

- Apply formats quickly and efficiently to Excel reports and understand the importance of features such as the Accounting format, Accounting Underlines, Precision as Displayed, Center Across Selection, and Flash Fill

- Work with date-oriented data in Excel and create calculations – such as those involving depreciation expense and interest accruals – involving the passage of time

Course Specifics

WC1224386941

June 10, 2024

Fundamental knowledge of Microsoft Office Excel 2019 or newer

None

Compliance Information

CFP Notice: Not all courses that qualify for CFP® credit are registered by Western CPE. If a course does not have a CFP registration number in the compliance section, the continuing education will need to be individually reported with the CFP Board. For more information on the reporting process, required documentation, processing fee, etc., contact the CFP Board. CFP Professionals must take each course in it’s entirety, the CFP Board DOES NOT accept partial credits for courses.

Meet The Experts

Thomas G. (Tommy) Stephens, Jr., CPA, CITP, CGMA, received a Bachelor of Science in Business Administration (Major in Accounting) from Auburn University in 1985. In 1994, Mr. Stephens opened his public accounting practice in the metropolitan Atlanta area. In his practice, Mr. Stephens provided accounting, tax, and consulting services to individuals and a wide variety of small and emerging businesses. He developed a successful consulting practice providing installation and support services of small business accounting software. Additionally, he has authored and presented continuing professional education courses to accounting and finance professionals. Mr. Stephens has lectured nationally on subjects such as internal controls for …

Related Courses

-

Computer Software & Applications

Computer Software & Applications

Artificial Intelligence for Accounting and Financial Professionals

K2 Enterprises (Stephen M. Yoss, Jr., CPA) Webcast

Credits: 4 $196.00

Webcast

Credits: 4 $196.00$196.00

-

Computer Software & Applications

Computer Software & Applications

Tax AI

Ashley Francis, CPA& Orumé Hays, CPA, CGMA, MST Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00

-

Computer Software & Applications

Computer Software & Applications

Digital Ledger: The Future of Note-Taking in Accounting

Sabrina P. Cook, CPA Webcast

Credits: 1 $49.00

Webcast

Credits: 1 $49.00$49.00