Western Alert

SSARS 25: 10 USEFUL PRO-TIPS

The AICPA Accounting and Review Services Committee recently issued Statement on Standards for Accounting and Review Services (SSARS) 25, Materiality in a Review of Financial Statements and Adverse Conclusions, effective for engagements performed in accordance with SSARS for periods ending on or after December 15, 2021. Early adoption was permitted.

Let’s start with a summary of the revisions and conclude with some pro-tips to assist with your Review Engagements.

Summary

The revisions include:

- The revision of the definitions of the following terms in AR-C section 60 to be consistent with the definitions in Statements on Auditing Standards: financial statements, designated accounting standard-setter, general purpose financial statements, general purpose framework, special purpose financial statements and special purpose framework.

- The addition of a requirement for the accountant to inform management of the reasons for withdrawal from a preparation engagement.

- The addition of the definition of limited assurance in AR-C section 90 as follows: “A level of assurance that is less than the reasonable assurance obtained in an audit engagement but is at an acceptable level as the basis for the conclusion expressed in the accountant’s review report.”

- The addition of an explicit requirement in AR-C section 90 for the accountant to determine materiality for the financial statements as a whole and to apply this materiality in designing the procedures and evaluating the results obtained from those procedures.

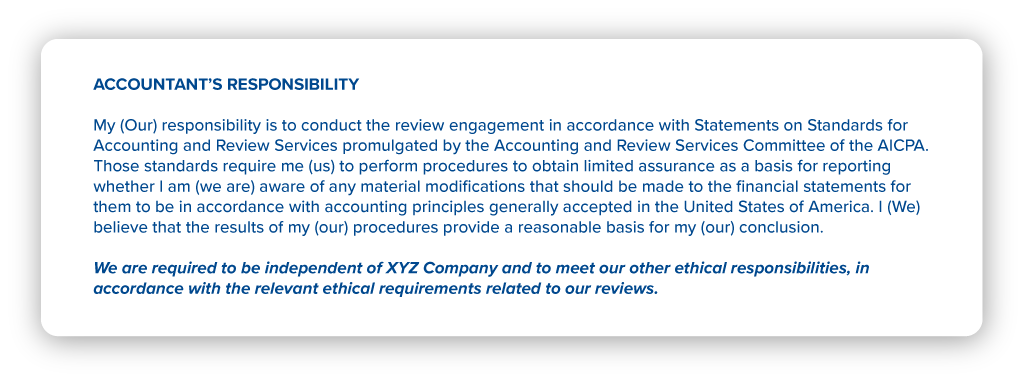

- Reviews require accountants to be independent but going forward under SSARS 25, this will be explicitly included in the Independent Accountants Review Report as follows:

- We are required to be independent of ABC Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements related to our review.

- We are required to be independent of ABC Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements related to our review.

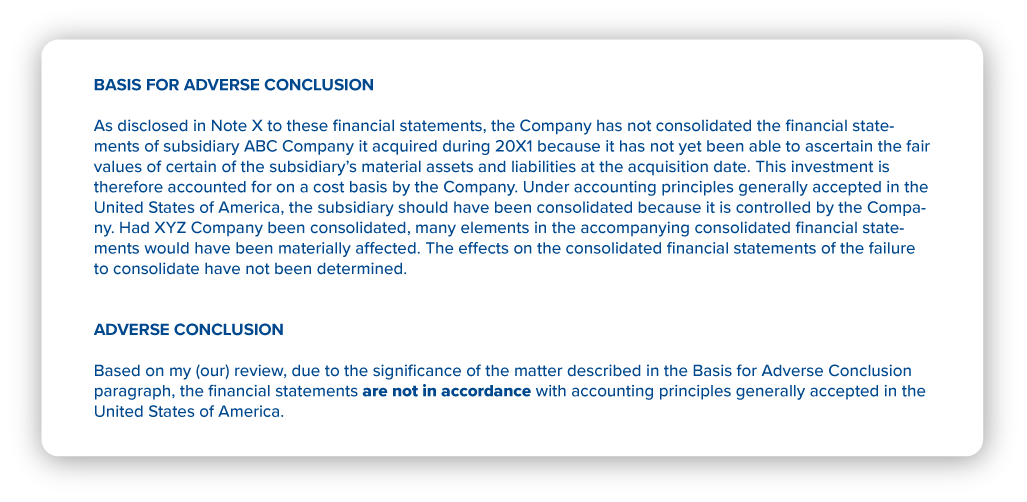

- An addition to AR-C section 90 that if the accountant determines, or is otherwise aware, that the financial statements are materially misstated, the accountant should express one of the following:

- A qualified conclusion, when the accountant concludes that the effects of the matter or matters giving rise to the modification are material but not pervasive to the financial statements

- An adverse conclusion, when the effects of the matter or matters giving rise to the modification are both material and pervasive to the financial statements.

- A qualified conclusion, when the accountant concludes that the effects of the matter or matters giving rise to the modification are material but not pervasive to the financial statements

Illustration of change to the Review Report for the requirement of the Independence Statement per SSARS 25 (Page 85-86):

Illustration of Adverse Conclusion in the Review Report as allowed per SSARS 25 (Page 86):

Experts in action: Sunish Mehta

Discover all of Sunish Mehta’s latest CPE courses. With over 25 years of experience and an engaging teaching style, you can’t go wrong.

Sunish’s Pro-Tips:

- Prior to SSARS 25 going into effect, accountants historically did not need to document anything around materiality. Some chose to document a materiality threshold chosen, in a simple memo to guide the engagement in terms of areas of focus.

- Many firms, INCORRECTLY used the Audit Materiality Worksheet on Reviews to calculate materiality with an annotation that the worksheet is being used on a Review. This was being easily picked up as a peer review deficiency.

- As of 2019, PPC and other methodologies introduced a Review Materiality Worksheet in advance of SSARS 25. Accountants can use these forms and should ensure they use the updated forms for Financial Statement Review of Periods ending on December 15, 2021 and onwards. SSARS 25 does not provide any required format for the Materiality Determination and so Accountants can continue to use a simple memo to do so.

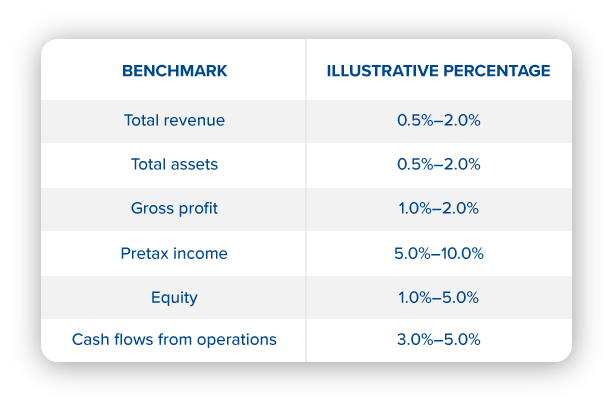

- Common Thresholds used for Reviews could include the following. This is not an all-exhaustive list:

- The Accountant should use their professional judgment to select the benchmark and percentage. There are no rules or requirements in SSARS 25 specific to this.

- The level of materiality needed to be documented would be similar to or the equivalent of overall planning materiality. There is no need to go into further details than this overall level.

- Any revisions proposed by the Accountant via the review procedures can be measured against this overall materiality level.

- Differences between accountant expectations developed via Analytics and the client’s recorded amounts can be accepted or not tolerated with this overall materiality as a measure.

- Remember, on reviews we provide limited assurance and that means limited work! SSARS 25 does not change that!

- Good Luck with your Review Engagements and remember to Stay in your Lane!

By:

By: